Retirement planning options abound, from indexed annuities, IRAs, and employer-sponsored retirement plans. But what exactly are indexed annuities, and how do they operate?

Indexed annuities are financial agreements with insurance firms, often known as equity-indexed or fixed-indexed annuities. These contracts allow investors to earn interest on the market index’s performance. These annuities can produce substantial returns, but there are also certain drawbacks.

Advantages of indexed annuities

Market-linked, fixed growth: Indexed annuities could provide a guaranteed minimum interest rate. Some investment techniques offer growth potential over the required rate since they are linked to stock market indices.

Access to money: You might be able to receive up to 10% of the value of the contract every year from an indexed annuity without paying surrender fees. However, unused funds under this clause may not be carried over to the following year.

Options for income selection: Payouts from annuities might be guaranteed for life or for a specific period. Additionally, if you pass away during the guaranteed period of your lifetime coverage, payments will still be made to your beneficiary.

Minimal return promise: Your indexed annuity’s issuing company might guarantee a certain minimum return even if the underlying index experiences a loss. For instance, even if the risk associated with it has a negative return, it can still pay out 2%.

Offer potential return that is higher than CDs: Indexed annuities have the potential to provide a greater return than certificates of deposit (CDs) and, unlike CDs, have the extra advantage of getting the taxes on earned interest postponed.

Delay paying taxes: As long as you don’t take money out of an annuity before you turn 59 and a half, all of them offer delayed taxes on your earnings. This enables growth that is tax-free and has higher interest earnings.

Option for lifetime income: The fear of outliving one’s assets and income is one of the main concerns among retirees. You can ensure a minimum annual return of 5% and a maximum annual return of 10% for the next 10-15 years by including a lifetime income rider in your indexed annuity contract.

Disadvantages of indexed annuities

It’s complex: Indexed annuities are a complex alternative for retirement income since they are linked to changing market indices and might have intricate contracts and restrictions. You’ll probably need to do your own research to ensure you’re getting the best deal.

Unpredictable: Indexed annuities can produce erratic returns because they eventually depend on the success of a market index, just like the stock market to which they are linked. You can end up with less money than you would have with a more secure or guaranteed retirement choice during a terrible market year or run of years.

Non-liquid: Although it’s not ideal, sometimes you must take money out of your retirement plans because life happens. While you can always take money out of your account, doing so will incur taxes and possibly a penalty of up to 7%.

Federal penalties on withdrawals before the age of 59: A federal tax penalty of 10% applies if money is removed from an indexed annuity before reaching age 59, just like it does for other annuities. Check your contract carefully because some won’t credit all or all of the interest if you withdraw money before the period has ended.

Who is an annuity suitable for?

Indexed annuities are the best option for anyone who wants to engage in the stock market but is concerned about losses. With all these contracts, you can benefit from some economic upside without worrying about a negative downturn.

Additionally, indexed annuities are a superior option for medium and long-term savings objectives. Investors can wait out a little market decline and subsequently benefit from better long-term index gains.

You might be best off with something that provides a higher level of guaranteed return, such as a fixed annuity or a CD, for short-term objectives or situations where you need some profits over the next several years. On the other hand, you may earn even more with a managed fund or a direct investment inside the stock market if you want the biggest return possible and don’t mind taking on additional risk.

Contact Information:

Email: [email protected]

Phone: 3604642979

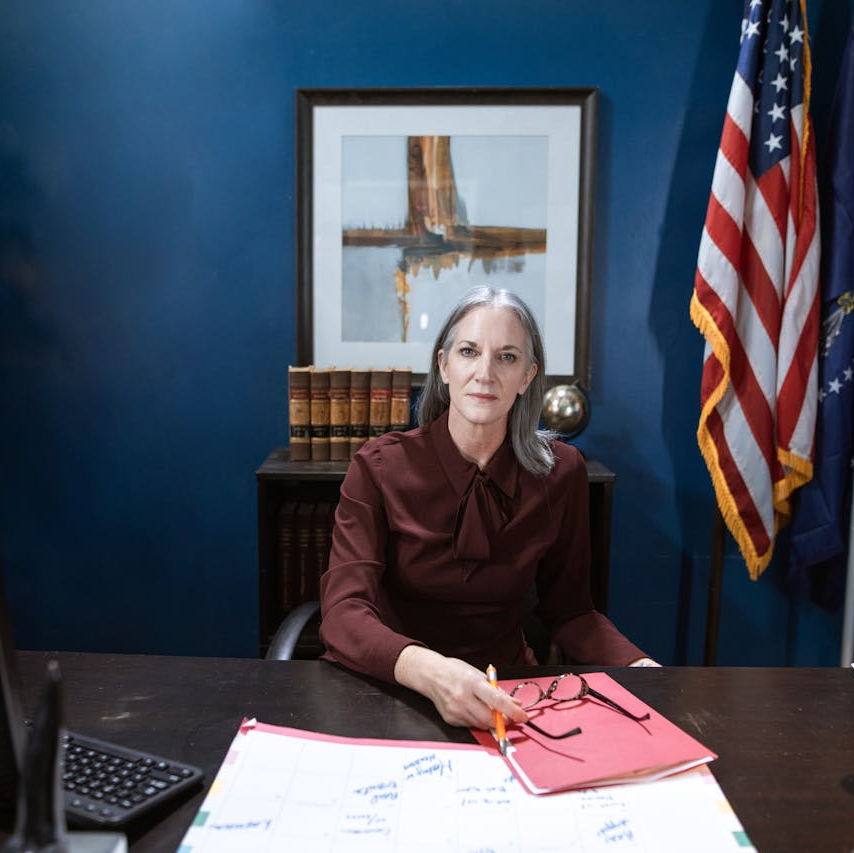

Bio:

After entering the financial services industry in 1994, it was a desire to guide people towards their financial independence that drove Aaron to start Steele Capital Management in 2013. Armed with an extensive background in financial planning and commercial banking coupled with a sincere passion for helping people, Aaron has the expertise and affinity for serving the unique needs of those in transition. Clients benefit from his objective financial solutions and education aligned solely with

helping them pursue the most comfortable financial life possible.

Born in Olympia, Washington, Aaron spent much of his childhood in Denver, Colorado. An area outside of Phoenix, Arizona, known as the East Valley, occupies a special place in Aaron’s heart. It is where he graduated from Arizona State University with a Bachelor of Science degree in Business Administration, started a family, and advanced his professional career.

Having now returned to his hometown of Olympia, and with the days of coaching his sons football and baseball teams behind him, he now has time to pursue his civic passions. Aaron is proud to serve on the Board of Regents Leadership for Thurston County as the Secretary and Treasurer for the Morningside area. His past affiliations include the West Olympia Rotary and has served on various committees for organizations throughout his community.

Aaron and his beautiful wife, Holly, a Registered Nurse, consider their greatest accomplishment having raised Thomas and Tate, their two intelligent and motivated sons. Their oldest son Tate is following in his father’s entrepreneurial footsteps and currently attends the Carson College of Business at Washington State University. Their beloved youngest son, Thomas, is a student at Olympia High School.

Focused on helping veterans and their families navigate the maze of long-term care solutions, Aaron specializes in customized strategies to avoid the financial crisis that care related expenses can create. Experience has shown him that many seniors are not prepared for the economic transition that takes place as they reach an advanced age.

With support from the American Academy of Benefit Planners – an organization with expertise and resources on the intricacies of government benefits – he helps clients close the gap between the cost of care and their income while protecting their assets from depletion.

Aaron can help you and your family to create, preserve and protect your legacy.

That’s making a difference.

Disclosure:

Investment advisory services are offered through BWM Advisory, LLC (BWM). BWM is registered as an Investment Advisor located in Scottsdale, Arizona, and only conducts business in states where it is properly licensed, notice has been filed, or is excluded from notice filing requirements. This information is not a complete analysis of the topic(s) discussed, is general in nature, and is not personalized investment advice. Nothing in this article is intended to be investment advice. There are risks involved with investing which may include (but are not limited to) market fluctuations and possible loss of principal value. Carefully consider the risks and possible consequences involved prior to making any investment decision. You should consult a professional tax or investment advisor regarding tax and investment implications before taking any investment actions or implementing any investment strategies.