Handling Money and Emotions While Entering Retirement in the Middle of a Health and Financial Crisis sponsored by Aaron Steele

As per Aaron Steele after spending years at a job doing hard work, paying off debts and saving for the family, Nancy Carlson is all set to retire. When she set her retirement date for the 30th of April, she hadn’t expected such volatility in the stock market,

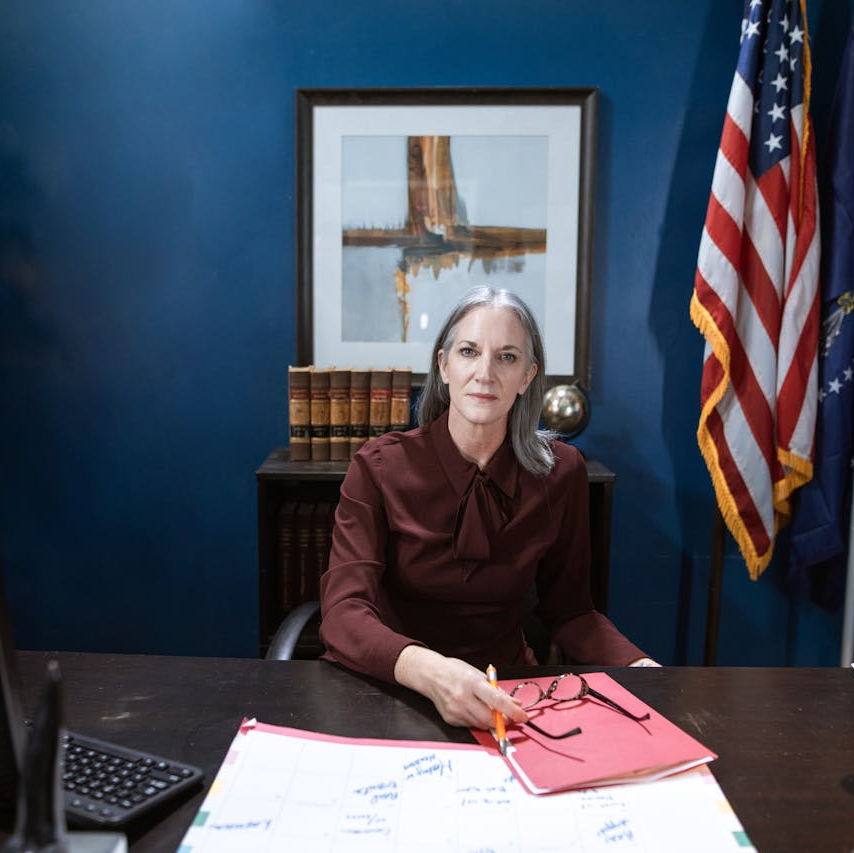

Recently, Carlson shared her fear and said that she manages technical writers in Disney World, and she’s felt that she is prepared for her retirement. She and her husband have no mortgage debt and have put their lovely kids in college. They all need to pay for their living expenses, taxes, and insurance after retirement. Her husband is a retiree, and she thought it was her time to join him.

- Also Read: Divorce and Your Federal Pension—What Happens When You Split Assets and How It Could Affect Your TSP

- Also Read: What Happens to Your Federal Benefits After Divorce? Here’s the Lowdown

- Also Read: The Best FEHB Plans for 2025: Which One Fits Your Lifestyle and Budget the Best?

Investment is emotionally-connected, especially when it’s linked to the life savings of a person.

The couple is smart and has other sources of income in addition to her 401(k) savings. This includes their pensions and husband’s Social Security benefits. She said it would have been great if the market stayed stable or continued to grow, but she decided to stick to her plan. Her financial advisor, Dennis Nolte, vice president of Seacoast Investment Services, has also advised her that she is financially prepared to take her retirement and should continue with her plan after doing years of hard work.

As per Aaron Steele this is just one case, but there are many near-retirees who may be hesitant to see their financial plan while entering retirement in the middle of ongoing coronavirus. Nate Wenner, principal and senior financial advisor at Wipfli Financial Advisors, said that it is quite tough because it feels like someone is pulling the Earth underfoot. To some people, everything has changed, and things will always be different.

Stocks are at their lows still experts and professional advice investors to play cautiously when the stock market is volatile. Historically, we can see that the stock market has always bounced back and dropped again.

That doesn’t mean near-retirees shouldn’t retire now. Many financial advisors are advising their clients to stick to their plans and retire as they intended to. We’ve done some research and come up with solutions for people who are entering retirement soon and aren’t as comfortable about their plan as they were a few months earlier.

Look for things that you can control

Near-retirees can’t expect what the stock markets have in store for them. But we can definitely control our reactions to volatility. Wenner said this is the main factor where near-retiree’s can put some effort on a primary basis. He further added that his firm has already started making adjustments to the client’s portfolio, like rebalancing and tax-loss harvesting. He’s also working on reviewing and updating longer-term financial plans for clients. Guiding them and showing them some steps that they can take can really make a difference, and those fundamental things will not change, even in a Coronavirus crisis.

Aaron Steele said although many near-retirees look for a financial advisor, they can focus on their assets and check where they are invested, their withdrawal in the first few years, their spending, and their claim on Social Security benefits.

Robert Braglia, president of American Financial & Tax Strategies, said that any financial planning is considered solid if it is planned taking market volatility and downturn into consideration. He further added that no one could predict this crisis, but any financial plan that was made without expecting a crisis is not described as a plan but is just a collection of investments.

Analyze the numbers

Now is the perfect time to analyze the numbers and check if your retirement is appropriate, and then rerun them. You can get help from your Financial advisors and get help with stress-test portfolios to learn how they manage a bear market or market volatility, and for how long your savings would last. Brian Behl, founder of Behl Wealth Management, said that means if a client’s financial plan was designed to pass a stress test a few months ago, then that near-retiree would be in proper financial place to retire at this time.

Malcolm Ethridge, executive vice president, and a financial adviser at CIC wealth said that a smart investor should calculate the guaranteed income that he or she will receive including pensions and Social Security benefits, and check how much money he or she needs to withdraw from savings to fill the gaps created by the ongoing crisis.

Cash is the life-saver

Jennifer Weber, vice president of financial planning at Weber Asset Management, said that emergency savings are always helpful, especially in the case of a crisis like this. All Financial advisors advise clients to keep aside three to six months of living expenses, but during times like this, it is advised to stash six to 12 months of expenses. This type of coverage will give you peace of mind and reduce the risk of selling your investments when the market is low.

Look for some working opportunities— if you want

Some people may end up with all of their income during these stressful times either working at their present job or some part-time — this section will give you some relief. Near-retirees don’t need to delay their retirement now. Sean Pearson, a financial adviser at Ameriprise Financial, said that some people get an opportunity of a phased retirement wherein he or she can take time off initially and get back to work part-time or project-based. This opportunity will give you time to recover your investments and help you enjoy continuity to work. It is essential to think about how to spend your time after retirement, as it is important to focus on your spending.

Don’t let your emotions ruin it.

If you are a near-retiree who has followed your financial plans and made correct projections, then your last step is to win over any feeling of fear. Kashif Ahmed, president of American Private Wealth, said that everyone is pressed to do something because that makes him or she feel better. But assuming that your plan was smart to start with, staying home and doing nothing would be an intelligent thing to do.

Nolte said everyone has a different path to retirement. Especially now, when people are scared, they are sharing their doubts and fears about retirement. The people working with you are more concerned about their own portfolios, and maybe they are not as safe as you, and have more years until retirement. You can never put yourself in their shoes. In other words, he said, forget about what everyone else around you is doing and how the current situation is impacting his or her plans — you have to stick to your plan.

It is imperative to look on the bright side, such as your freedom, that will come with retirement. Your immediate plans may have changed due to circumstances, but they are temporary. Carlson added that she planned a few trips this summer — one to Italy and another to Alaska via cruise — but now her plans won’t happen, and she will reschedule them. She is happy with the fact that she no longer has to wake up with an alarm next to her every day.